Monitor My Mortgage

Background

Monitor My Mortgage (M3), a Canadian mobile and web app, aim to break the veil of secrecy and ambiguity around mortgage for borrowers. Banks and lenders try to get the best rates for themselves, getting the most that they can get out of borrowers. This is where M3 comes to the rescue. Users can track their mortgages, receive notifications about rate changes, find the best rates and lenders when refinancing or renewing, calculate penalties, track Bank of Canada interest rates, and take control of their mortgages from start to finish.

Challenge

Banks and many mortgage lenders do not look out for the best interests of their borrowers but try to make as much money from their lack of knowledge as possible. Only some people know mortgage management and many financial institutions take advantage of this fact.

This leads to the following problems for borrowers –

- Lack of knowledge about market rates or changing rates.

- There is difficulty understanding penalties and their calculation.

- They feel pressured into refinancing or renewing the mortgage with the same bank. Banks only call their customers at the last minute, making it difficult to look around the market for better options.

- Not having sufficient knowledge about developments in the mortgage market can affect the borrower’s situation.

Solution

The Opportunity

Monitor My mortgage puts the control back in the hands of borrowers, equipping them with all the necessary tools and information to manage their mortgages efficiently without getting swayed or influenced by their lenders. It provides all the critical information that can affect the user’s mortgage and specific situation.

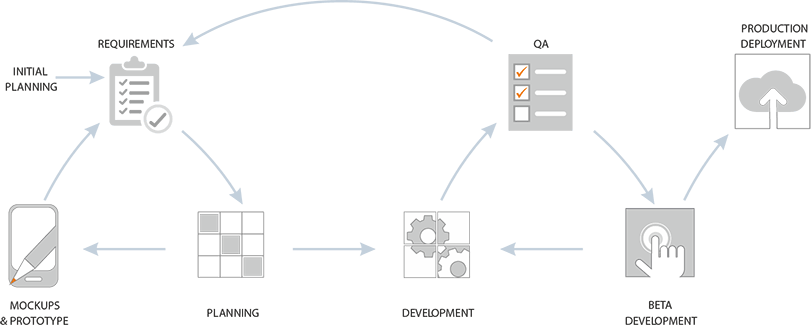

We follow A systematic method to get to solutions

- Wireframes

- Prototypes

- Coding

- Testing

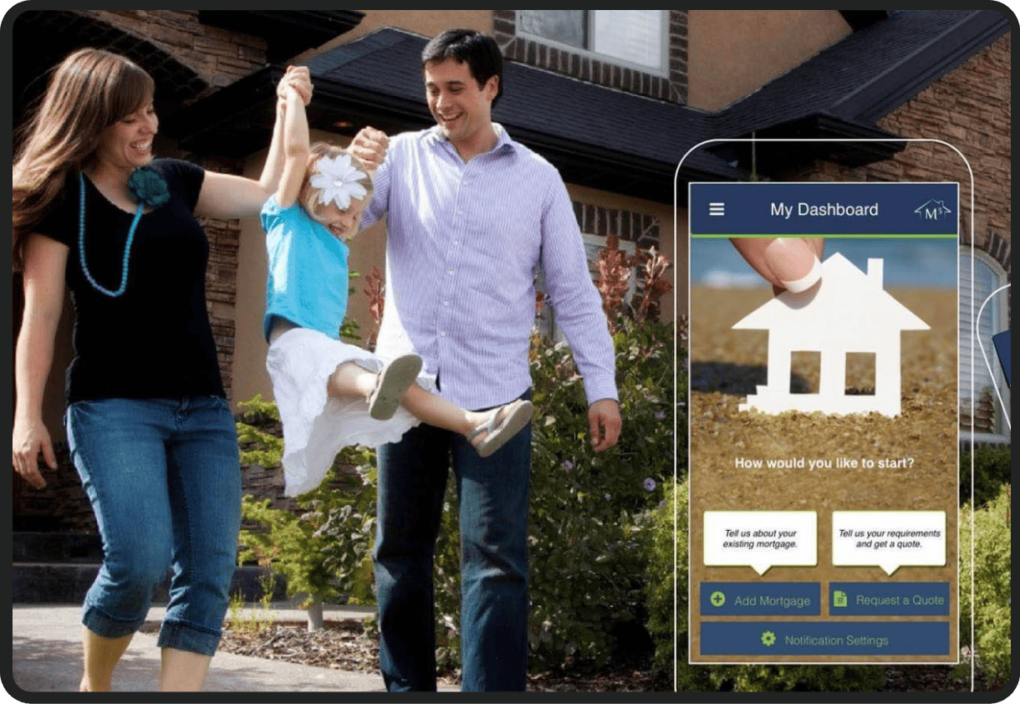

Monitor My mortgage was developed to provide buyers with complete information about the mortgage landscape before renewal or refinancing.

- Dashboard for adding and tracking current mortgage.

- One-to-one consultation option with M3 vetted mortgage partner for discussing opportunities.

- Notifications regarding rate changes, renewal or refinancing dates, new interest offers from vetted lenders, etc.

- Information about the mortgage landscape.

Technology Used

Prototyping

Axure

Axure Photoshop

Photoshop

Frontend & Backend

Meteor

Meteor

Database

MongoDB

MongoDB Neo4j

Neo4j

Mobile Apps

Native iOS

Native iOS Native Android

Native Android

Testing

Selenium

Selenium

Benefits

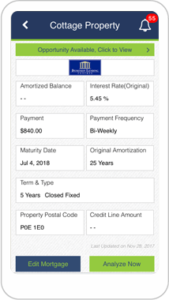

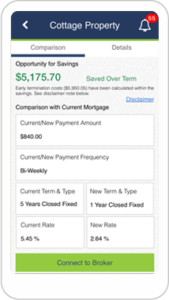

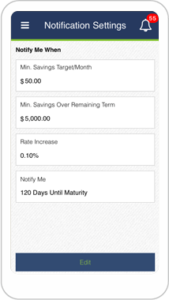

M3 is not a mortgage lender but a free app for all the information affecting a mortgage buyer’s financial condition. Users can add their existing mortgage details like total amount and rate, set notification dates, custom savings, reminders, and alerts; the system monitors your mortgage daily and sends notifications regarding your custom reminders or market opportunities. M3 lets users talk to their vetted lender partners for better mortgage-related opportunities.

The app also provides tools to manage existing mortgages by considering changes like fixed and variable interest rates, Bank of Canada interest rates, approaching maturity, penalty calculation, and refinancing or renewal option. In a nutshell, Monitor My Mortgage puts the power of mortgage management back into the buyer’s hands.

Solution highlights

User can add details by:

- Adding a new mortgage

- Requesting a quote for a new mortgage from vetted lender partners

- Providing amount, interest, and period details

Users can set notifications for:

- A reminder of refinancing or renewal a specified period in advance

- Changes in interest rates

- Fixed and variable rate and savings opportunities

Talk with lender partners who are thoroughly vetted for opportunities in fixed or variable rates, refinancing, or renewal.

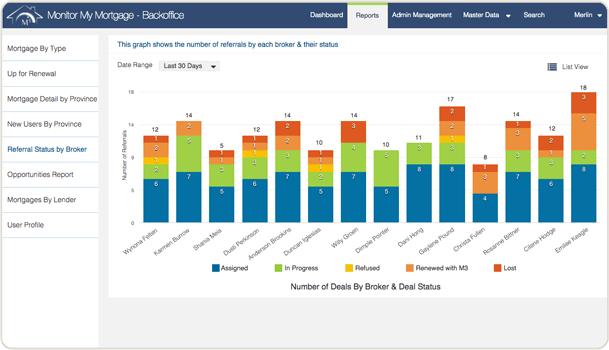

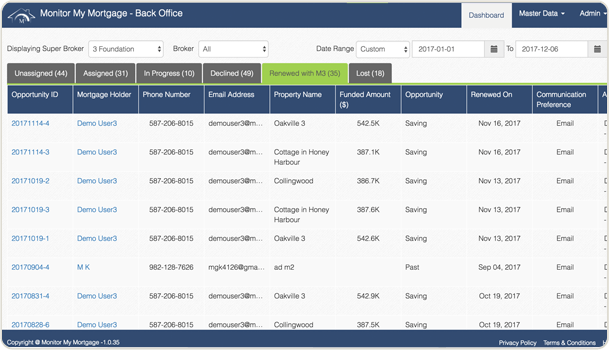

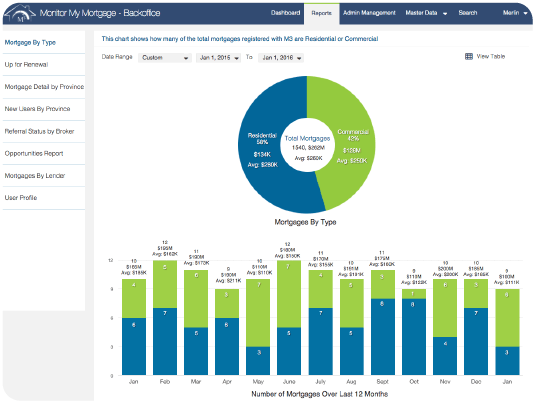

Web & App Screenshots